Buy now, pay later has gotten popular during the pandemic. More consumers are using this form of payment to make occasional purchases. One of the most popular platforms is Sezzle, a payment solution that allows you to pay in 4 interest-free payments.

How Sezzle works

Sezzle can be used with any store offered in their catalog. The buying process is the same as any website, with Sezzle being a payment option on checkout.

I discovered Sezzle when I was buying car parts for my Acura MDX on Partsavatar and decided to try it on checkout. The whole process was seamless and account creation took less than 5 minutes. To no surprise, $476 was split into four interest-free payments of $119. Each payment was due bi-weekly (14 days apart). You can add a debit card, credit card, or bank account as your form of payment.

Sezzle also has an app that allows you to check and manage upcoming payments. The app is well designed, simple, and intuitive. My favorite feature on the app is the ability to postpone payments if you need more time. It’s crucial to make payments on time; missing payments can result in a permanent ban or an account hold. I urge you to make a budget and plan ahead of time.

Why use Sezzle?

It depends, everyone has different reasons. It might be a big Christmas purchase; possibly waiting for payday, or other responsibilities take precedence, and you prefer paying in installments. Whatever the reasons, it’s important to be responsible as this can easily turn into a financial burden. It might be wise to avoid buy now, pay later platforms if you don’t have any form of recurring income.

Sign up for Sezzle and get 5$ off your next order.

Are you declined?

Sezzle’s verification process is a mystery, but their site mentions that they only run a soft credit check. Double-check and use the correct address, name, and birthdate when you sign up to avoid errors. If all your information is correct and it’s still declined, try to order something small to build trust.

Can you build a credit score with Sezzle?

Sezzle can be used to build credit score if you upgrade your account to Sezzle Up. This allows Sezzle to report your payment history to the credit bureaus (TransUnion and Equifax). If you opt for this option, each payment will affect your credit score. To learn more about credit scores, click this link.

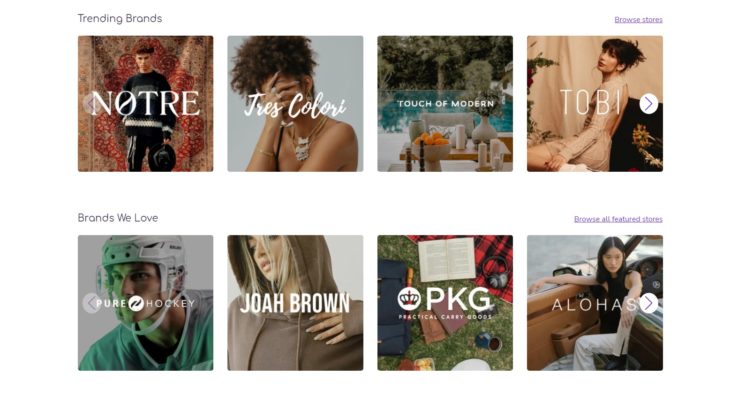

Offered stores.

There are more than 20,000 active stores in selection. From fashion brands, beauty shops to electronics, there is something for everyone. My favorite stores are Partsavatar (especially when I need emergency car parts) and Swiftronics (they sell good electronics). To check out Sezzle’s catalog of stores, click this link.

Shoppers who have repaid 4 orders of $30 or more, will have access to exclusive merchants, that allow you to purchase a gift card that can be used in-store or online. One of these exclusive merchants is Bestbuy and Walmart. This is great news to anyone who loves tech and wants a simple interest-free buying solution. To buy from best buy, log in to Sezzle, click Best Buy, choose in-store or online and enter the amount you need for your purchase. You can also sign up for a Sezzle virtual card at select stores.

How does Sezzle make money?

Sezzle makes money via merchant fees (6% transaction fees), late payment fees, and interchange fees. However, the bulk of their revenue comes from merchant fees.

Pros

- Simple intuitive app

- Great selection of stores

- 4 interest-free payments

- Access to virtual cards

- Can purchase gift cards

- Payments can be delayed

- Local stores are featured

Cons

- Can become overwhelming for anyone who is not responsible with money

- Few electronic stores

Alternatives

- Afterpay

- Paybright

- Klarna

To learn more about Sezzle, here is a link to their FAQ page.