Wealthsimlple is one of the best investing platforms in Canada. It offers a variety of services and tools that can kickstart your financial goals and investing endeavors. Wealthsimple was founded by Micheal Katchen in September 2014, with the goal of bringing smarter financial services to everyone. Currently, the firm holds over $10 billion in assets under management and growing.

One of their most popular products is Wealthsimple Invest. It offers an advanced Robo advisor, that analyzes the market and chooses the best products for your portfolio. This service will appeal to anyone who is new to investing, millennials, and experienced investors.

Opening an account and choosing a risk level

- Signing up is easy, fast, and without complications. It takes about 5 minutes to register. The next step is to choose an account type and the risk level for your portfolio.

- There are many account options to choose from. RRSP, TFSA, Personal, RESP, RRIF, LIRA, Joint, and Business.

- Depending on your financial goals, Wealthsimple allows you to choose a risk level for your portfolio. There are 3 options to choose from; Conservative, balanced, and growth. If you anticipate that you’ll need the money fairly soon, a conservative portfolio might be your best option. However, if you want optimum growth in the long run, a growth portfolio will be more suitable. Sign up here and get $10,000 managed free for 12 months

Features and benefits

- Auto deposits. This is a neat feature that makes the whole experience autonomous. Money will be deducted from your bank account depending on the time, day, and frequency you choose.

- Dividends will be automatically reinvested, growing your portfolio.

- Simple user interface and well-designed mobile app.

- Intuitive tools to inspire you to invest. Such as a graph estimating how much your investments could grow if you put a certain amount at a fixed period in time. You can also track your TFSA and RRSP to avoid overcontribution.

- It’s a great saving tool. There is a Roundup feature that links to your debit/credit card. Wealthsimple will round up your everyday purchases and invest the “spare change.”

- Overflow. You can decide how much money you want to keep in your bank account. Wealthsimple will deposit any amount that exceeds the set amount. This works well for anyone who wants to budget and invest simultaneously.

- No minimum deposit. This is great news for anyone who is on a tight budget. While other competitors require you to have a minimum balance before you can open an account, Wealthsimple Invest makes it easy for anyone to start investing. (Note: Try to budget and invest money that is not needed. It might even be wiser to build an emergency fund first before you start investing.)

- Automatic rebalancing. Your portfolio is rebalanced as the market changes.

- Wealthsimple Invest has low management fees. 0.5% for accounts under $100,000 and 0.4% for clients that have $100,000 or more in their accounts (You will automatically qualify for the premium Wealthsimple black plan once you have net deposits of $100,000 or more.)

- Variety of account options including TFSA and RRSP accounts (Learn more about TFSA accounts here)

Click to earn more about TFSA Accounts!

Premium Accounts

- As a Wealthsimple Black client, you’ll have access to an experienced Portfolio Manager, one on one customer service, and goal-based financial planning.

- If you deposit $500,000 or more, you can sign up for the Wealthsimple Generation plan which opens up nice perks such as; A dedicated team to manage your finances and a 50% health insurance discount from Medcan.

Social Responsible Investing

- Wealthsimple offers the option to invest in socially responsible companies. ETFs (Exchange-traded funds) that are traded will be carefully screened for environmental and social impact. This shows how committed Wealthsimple is to cater to everyone’s financial goals and beliefs.

- SRI (Social Responsible Investing) portfolio will include WSRI (Socially responsible companies in North America); WSRD (Socially responsible companies in developed markets globally) and Bonds & Gold. Depending on your chosen risk level, your portfolio will have different ratios of WSRI, WSRD, and Bonds & Gold.

- What type of companies are featured? According to Wealthsimple, 25% of carbon emitters in each industry are eliminated from the ETF; and every company that is included has at least 25% or at least 3 women on their board of directors.

Halal Investing

- Wealthsimple offers the option for Muslims to invest in companies that comply with Islamic Law. All investments will be screened by a third-party committee of Shariah scholars and certified by a team of Islamic researchers at Ratings Intelligence Partners.

- Investments will exclude companies that profit from gambling, arms, tobacco, and any other restricted industry such as; pork-related products, conventional banking, adult entertainment, and insurance companies.

- Depending on your chosen level of risk, a Halal investing portfolio will include WSHR (Shariah-compliant equities in developed markets globally), Gold, and Non-interest bearing cash.

- I don’t know much about the Muslim religion and this specific product. Please read more information about this portfolio here. Nevertheless, it’s great to see Wealthsimple going above and beyond for its customers.

Cons

- few funding options. You can only fund your account with a bank account which takes 2-5 days

- Withdrawals take time. When you need to withdraw money, it can take 3-7 days to get your money

- Few human interactions. If you’re not a member of Wealthsimple Black or Wealthsimple Generation, the chances of talking to a real human advisor are low. However, you can speak to a person during business hours if you have questions about your application, account, or service.

- No physical branches

Is it safe?

- Wealthsimple is affiliated with Canadian ShareOwner Investments and all accounts are insured by CIPF (Canadian Investor Protection Fund)

- All information is encrypted and the platform has two-factor authentication (2FA)

- Wealthsimple is backed up by over $1 billion in investments. The company is currently valued at $5 Billion as more investors grow an interest in the company. Celebrities like Drake, Ryan Reynolds, Micheal J.Fox, Kelly Oylynyk, Dwight Powell, and Patrick Marleau have chipped in with 15 venture capital investment firms (including Meritech, Greylock, Dragoneer, and iNovia) to raise $750 million.

- Wealthsimple manages over 10$ billion in assets. This indicates growth, potential, and most importantly, “trust”.

Should you use Wealthsimple Invest?

Absolutely. Wealthsimple is a great investing platform that offers tools and services at an affordable price. From its appealing user interface to its impressive award-winning Robo Advisor; Wealthsimple Invest has opened the door for anyone to get into savings, investing, and financial planning.

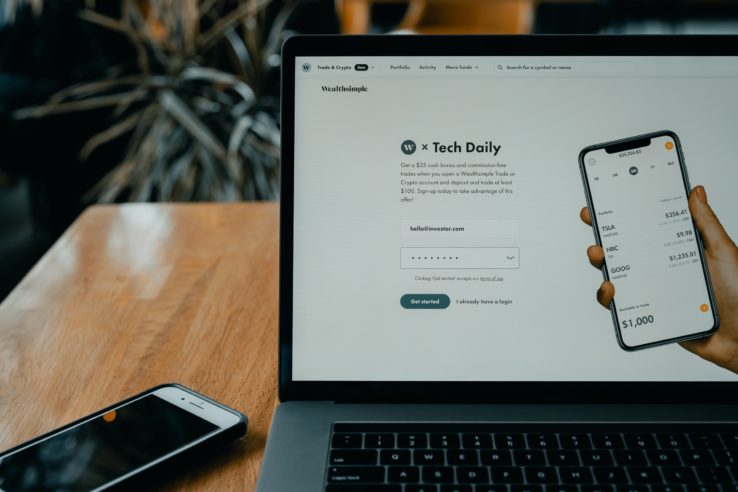

If you’re more of a DIY type of investor, take a look at their trading app here. The service is commission-free and you can also trade cryptocurrencies. Read more on Wealthsimple Crypto here.